what is a quarterly tax provision

If you owe 1000 or more on your tax return including any estimated payments youve already made. What is a tax provision.

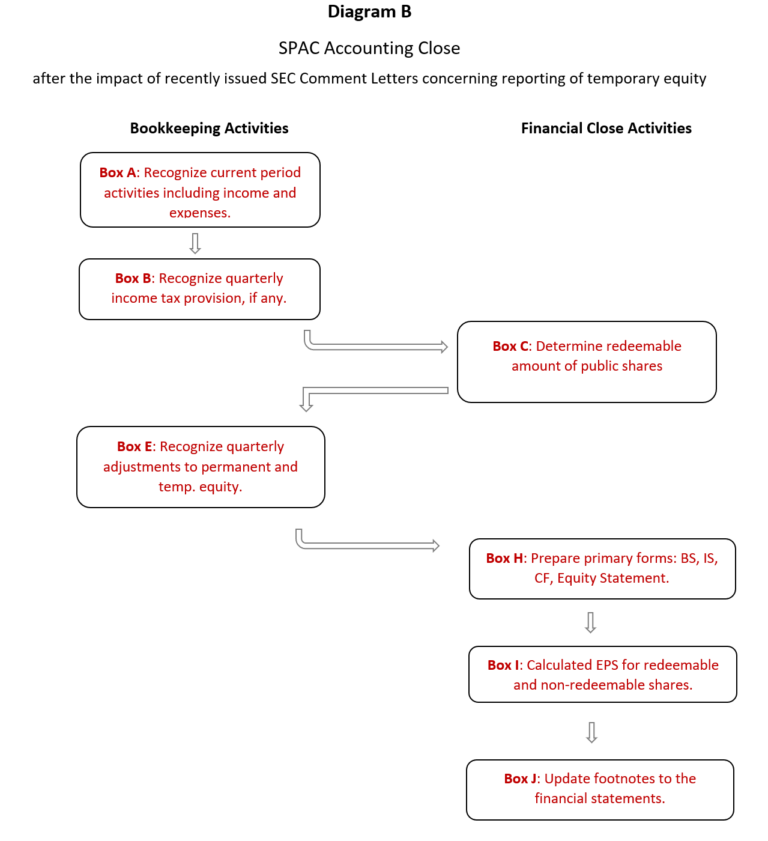

Asc 740 Interim Reporting Bloomberg Tax

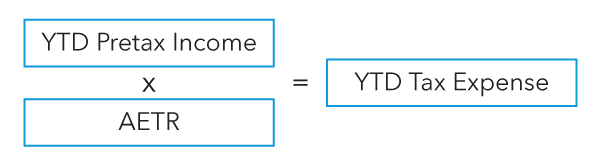

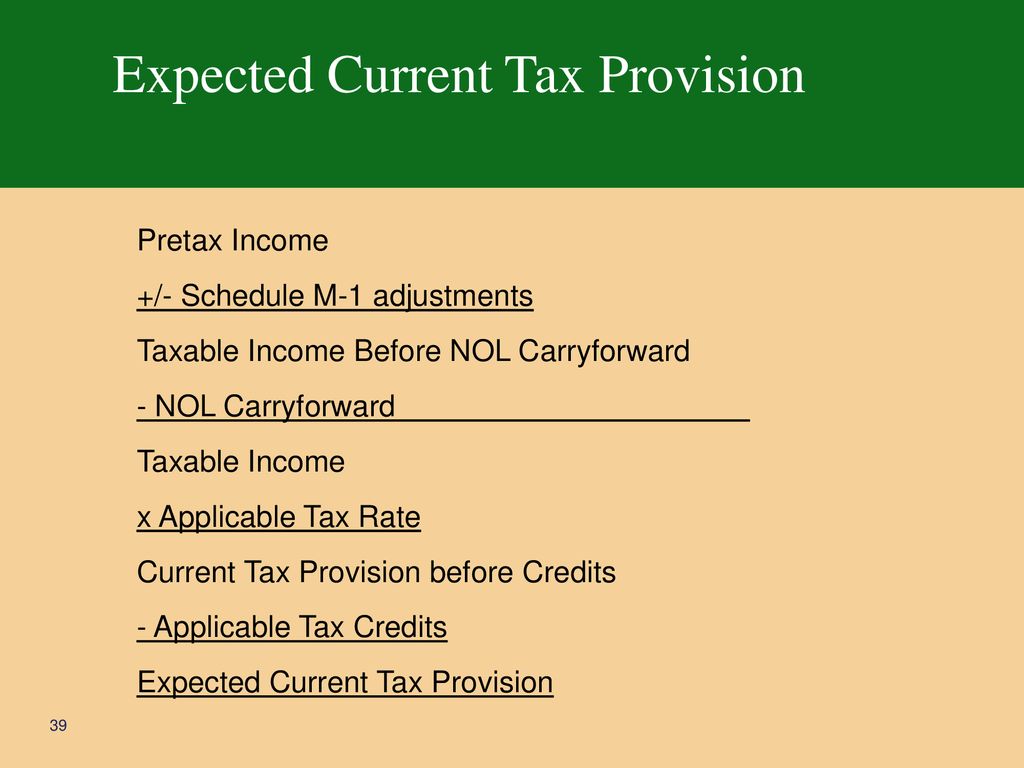

A tax provision is comprised of two parts.

. This guidance addresses the issue of how and when income tax expense or benefit is recognized in interim periods and distinguishes between elements that are recognized through. A tax provision is just. An income tax provision represents the reporting periods total income tax expense.

Our practice is based on an incredibly. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. Recent editions appear below.

The tax provision is part of the audited financial statements and therefore it impacts the companys earnings and earnings per share. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. The amount of this.

Typically this is represented. Heres an easy guide to help you get it right. The provision can be calculated on a monthly.

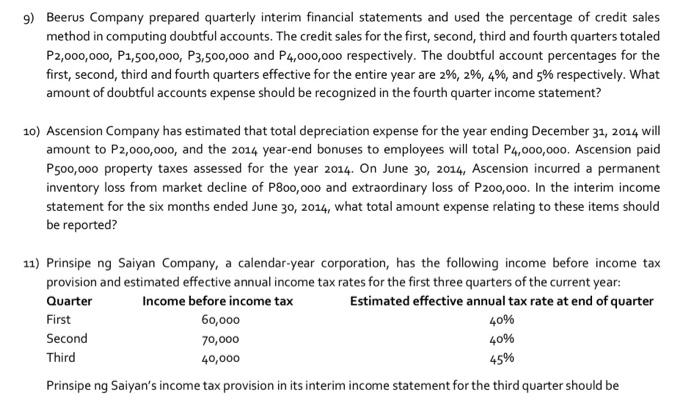

Subscribe to receive Accounting for Income Taxes. The corporate income tax provision is an important and complex component of the financial statements and related disclosures and it is receiving ever. For question 1 base company tax on 275 of annual profits paid quarterly for question 2 revenues 10-DCoverheads above loan repayments.

After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports. Since you owe more than 1000 in taxes the estimated annual tax is what youre going to base your quarterly taxes on. What is a Tax Provision.

Who Must Pay Estimated Tax Individuals including sole. Information that is to be reported quarterly includes tax summary details as well as wage information on all employees. All you have to do is divide that total amount.

This article will highlight some of the important aspects of an income tax provision and how it clarifies GAAP financial statements. Estimated quarterly tax payments are tax payments made during the year on income that hasnt had withholdings taken by an. Treasury today issues six requests for comment on key provisions to lower energy costs tackle climate change WASHINGTON DC.

Publication 505 Tax Withholding and Estimated Tax provides more information about these special estimated tax rules. This includes federal state local and foreign income. The primary determining factor is how much you will owe in total.

A tax provision safeguards your business from paying penalties and interest on late taxes. Tax rate changes in the quarter in which the law is effective. Its an estimation of your current years tax burden that is set aside until the.

The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. Quarterly Hot Topics directly via email. Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in.

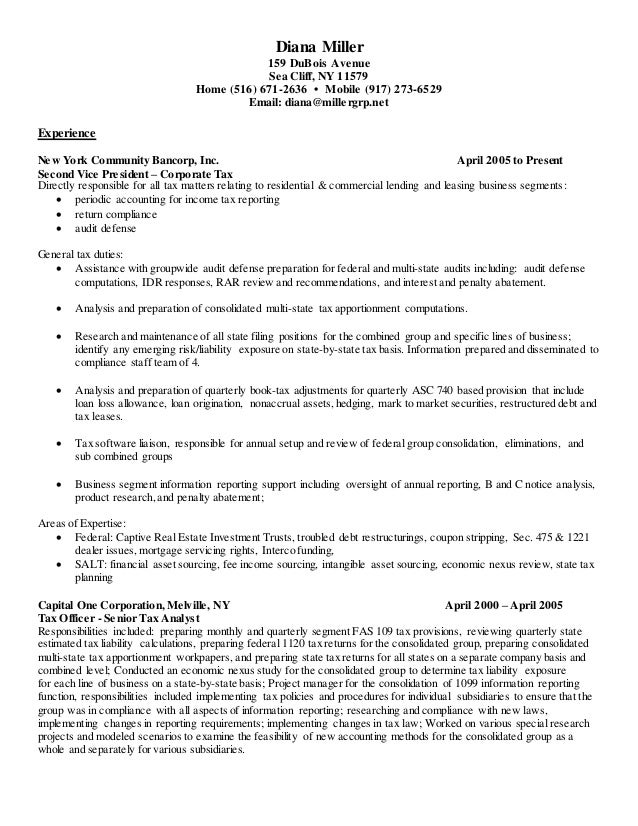

So if you paid 90 of your final bill in estimated. For older issues please email a request to. Tax Provision ASC 740 Due to the high risk impacts of Tax Provision we have developed a dedicated practice with extensive expertise in this area.

Banque Saudi Fransi Quarterly Net Profit Down 4 4 On Islamic Tax Provision Uae News

Tax Analyst Senior Resume Samples Velvet Jobs

Senior Tax Analyst Resume Samples Qwikresume

Solved 9 Beerus Company Prepared Quarterly Interim Chegg Com

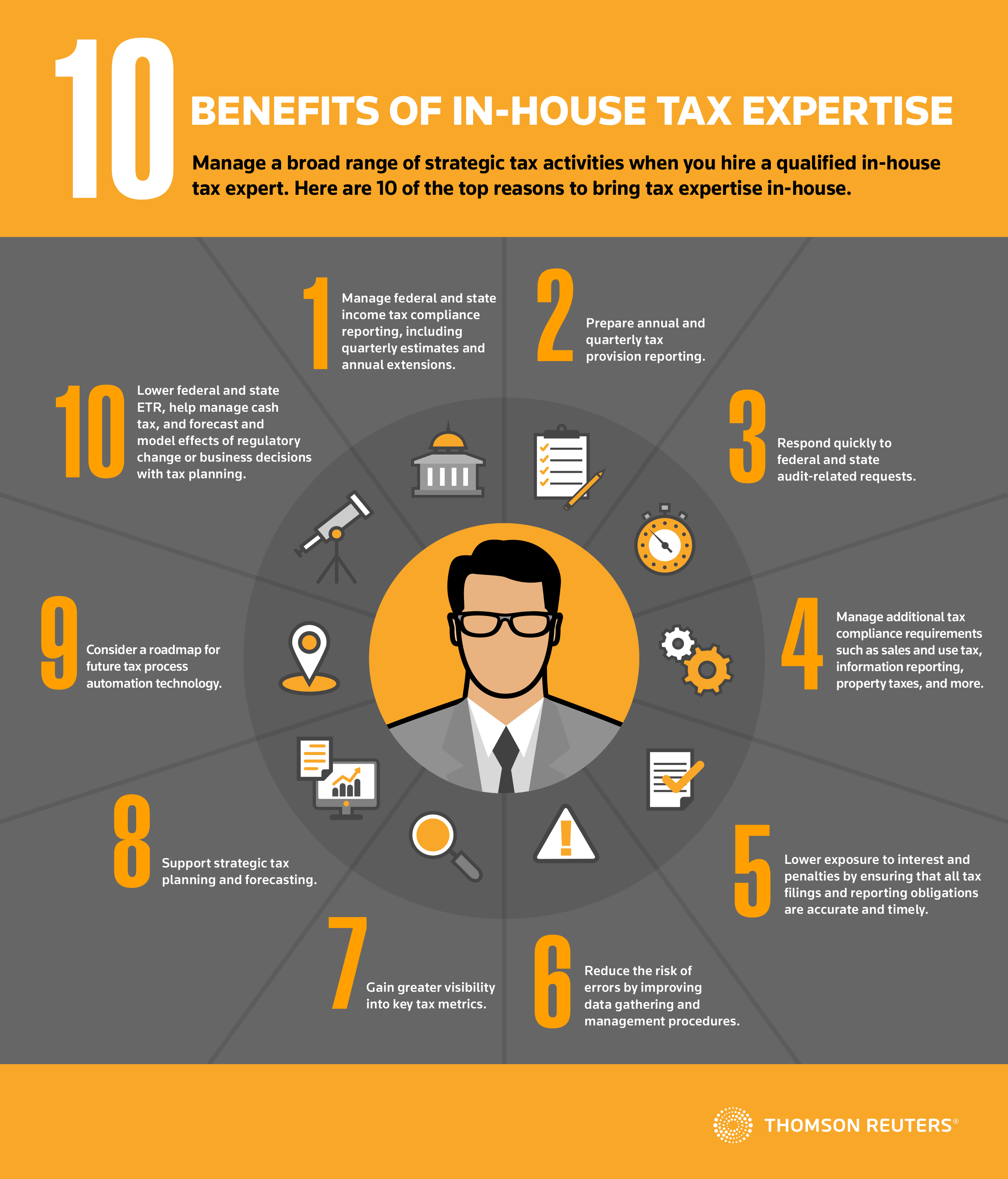

10 Benefits Of In House Tax Expertise Infographic

What Is A Provision For Income Tax And How Do You Calculate It

Change Form Service Data Relocation Jan 2020

Apple S Latest Quarterly Income Statement Visualised Oc From Instagram Chartrdaily R Dataisbeautiful

Gregory Danisch Vice President Tax Assistant Treasurer Endurance International Group Linkedin

Guocoland Posts Ninth Straight Quarterly Loss Dragged By Loss On Investment And Tax Provision The Edge Markets

Provision For Income Tax Definition Formula Calculation Examples

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Income Tax Accounting Sfas 109 Asc Ppt Download

Journal Entry For Income Tax Refund How To Record In Your Books